A month where you don’t spend on anything but the essentials. Imagine a month where every penny counts, and you’re in full control of your spending. You’re not alone in this adventure. Many have embarked on this journey, known as the No Spend Month, to reset their financial habits.

It’s all about being mindful with money, and it can lead to significant savings. This guide will walk you through the ins and outs of preparing for and succeeding in your No Spend Month challenge. Are you ready to take control of your finances? Let’s dive in!

A No Spend Month is a financial challenge where you commit to spending only on essentials for an entire month. The main goal is to develop self-discipline and become more mindful of your spending habits. During this time, you cover necessary expenses like groceries and bills, while avoiding non-essential purchases like eating out or buying new clothes.

This exercise allows you to rethink your spending priorities, save money, and can lead to personal growth. It’s a chance to appreciate what you already have and make thoughtful financial decisions.

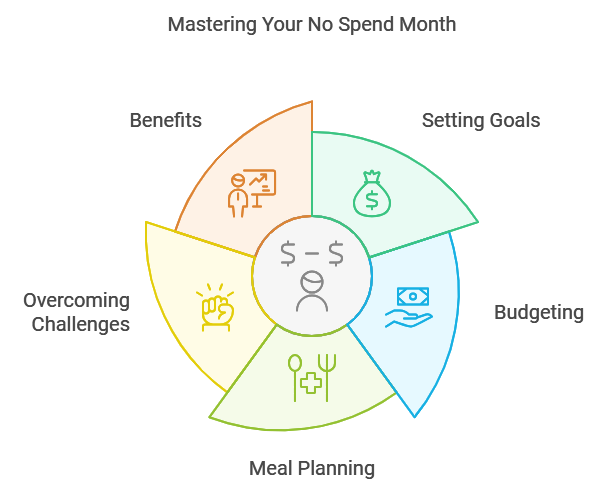

Preparing for a No Spend Month requires a solid plan and determination to stick to it. Start by setting clear goals, which will guide your spending limitations. Then, make a budget that ensures you cover all essentials while avoiding unnecessary purchases.

Additionally, planning meals and activities in advance can help you stay on track without the temptation to overspend. Let’s dive into these steps to ensure a successful No Spend Month.

Setting clear financial goals is the cornerstone of a successful No Spend Month. First, identify what you aim to achieve, whether it’s saving a specific amount, reducing debt, or gaining insight into your spending habits. Goals provide motivation, serving as a constant reminder of your purpose throughout the month.

Break down your goals into achievable milestones, and celebrate small victories to keep yourself motivated. Keep a journal or use a money-tracking app to monitor your progress, which can help you stay focused and accountable.

Creating a budget is an essential step toward managing your finances effectively. A well-structured budget helps you track your income, control your spending, and save for future goals. Here’s a step-by-step guide to help you create a budget:

Planning meals and activities can significantly enhance your overall well-being, save time, and reduce stress. Here’s a structured approach to help you effectively plan your meals and activities for the week.

By following these steps, you can navigate a No Spend Month with ease, achieving your financial goals while discovering new ways to enjoy life without spending.

PA no-spend month can be a transformative experience, offering numerous benefits that extend beyond financial savings. By consciously choosing to avoid non-essential purchases, individuals can gain valuable insights into their spending habits and overall lifestyle. Here are some key benefits of undertaking a no-spend month:

Benefits of a No-Spend Month:

Overall, a no-spend month serves as both a financial detox and an opportunity for personal growth, prompting individuals to reassess their priorities and appreciate the value of experiences over material possessions.

When embarking on a No Spend Month, participants may encounter various challenges that test their resolve. From resisting the urge to make impulsive purchases to navigating social situations where spending is the norm, these hurdles can be significant.

However, with awareness and strategic planning, it’s possible to face these obstacles head-on and stay on track without compromising the overall goal of financial discipline.

During a No Spend Month, one might find themselves tempted by sales, advertisements, or the simple desire to enjoy a treat. These temptations can be tough to resist, but staying focused on your goals is key.

Remind yourself of why you started this journey and the benefits it can bring. Keeping a list of free activities or hobbies can help divert attention away from spending.

Each time an urge arises, take a deep breath and engage in an activity that doesn’t require money. This approach not only strengthens your resolve but also helps you find joy in simple pleasures.

Social situations often come with the expectation to spend, be it dining out or splitting a gift. To handle this, openly communicate your No Spend Month commitment with friends and family.

Most people will respect your decision and may even join you in finding creative, cost-free ways to spend time together. Suggesting alternatives like potlucks or home movie nights can maintain social bonds without financial strain.

Remember, it’s about making mindful choices that align with your goals, and true friends will value your efforts and support your journey.

| Aspect | Details |

|---|---|

| Challenge | No Spend Month |

| Initial Perception | Can seem challenging |

| Preparation | Track every expense for a week before the challenge to understand spending habits |

| Support Network | Involve friends or family for shared experiences and motivation |

| Creative Alternatives | Explore free activities (e.g., walking in the park, starting a new home project) |

| Spending Focus | Prioritize needs over wants; focus on essential purchases only |

| Budget Flexibility | Adjust your budget if unexpected costs arise while maintaining the challenge’s spirit |

| Mindset | Aim for progress, not perfection; be patient with yourself |

| Celebration of Progress | Celebrate small victories throughout the month |

| Outcome | Achieve financial benefits and personal growth, making your No Spend Month a success |

On a No Spend Month is a transformative journey that can significantly enhance your financial well-being. By carefully planning and adhering to set goals, you can effectively manage spending habits and foster a healthier relationship with money.

This challenge not only aids in saving but also promotes mindfulness, helping you appreciate non-material joys. As you navigate the ups and downs, remember the long-term benefits that await.

Feeling inspired to take control of your finances? Dive deeper into our blog for more insightful tips and strategies to empower your financial journey!